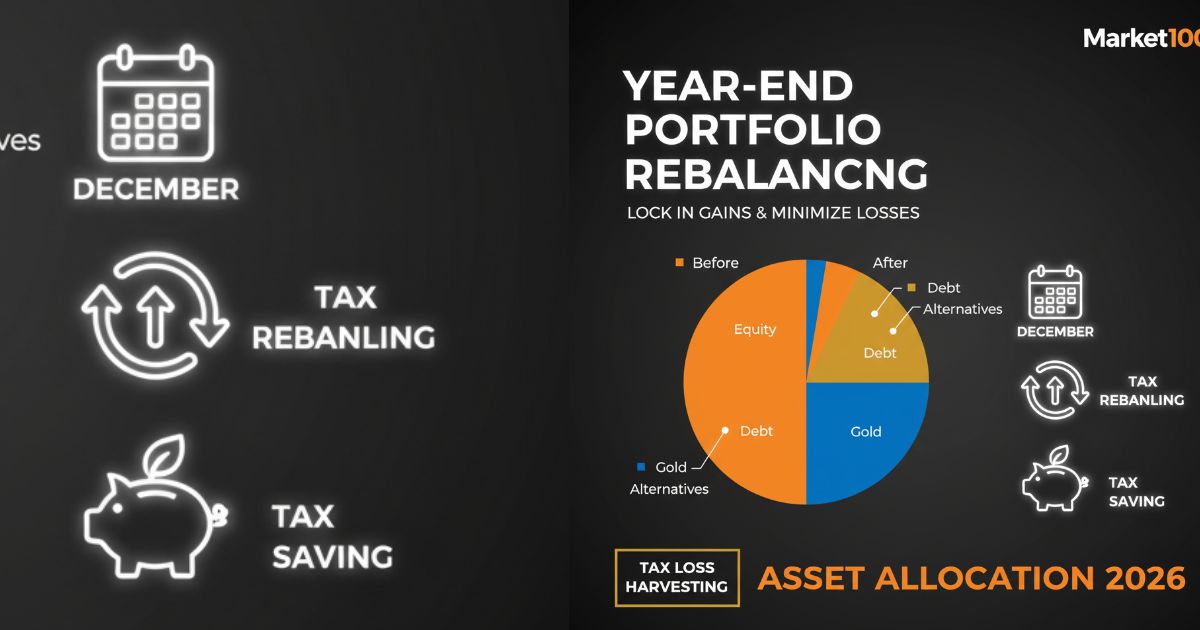

Year-End Portfolio Rebalancing December 2025: Complete Strategy to Lock in Gains & Minimize Losses

क्विक समरी: December Portfolio Rebalancing 2025

- जरूरत क्यों है: 2024-25 में equity markets ने exceptional returns दिए हैं, जिससे आपका asset allocation original plan से drift हो गया होगा

- Tax deadline: 31 मार्च 2026 से पहले tax loss harvesting complete करना जरूरी है

- Best timing: December-January में rebalancing करने से आपको पूरा financial year मिलता है planning के लिए

- Expected benefit: 10-15% तक tax savings और portfolio risk में 20-30% की कमी

- Action required: अगले 30 दिनों में portfolio review और rebalancing execute करें

December में Portfolio Rebalancing क्यों है Critical

Financial year 2024-25 में भारतीय stock market ने impressive performance दिया है। Nifty 50 ने लगभग 12-15% returns generate किए हैं, जबकि mid-cap और small-cap segments ने 20-25% तक का growth दिखाया है। इस exceptional performance की वजह से ज्यादातर investors के portfolios में asset allocation drift हो गया है।

Market Scenario December 2025

Current market conditions December 2025 में ये indicate कर रहे हैं:

- Equity overweight position: अगर आपका original allocation 60% equity था, तो अब वो बढ़कर 70-75% हो सकता है सिर्फ market appreciation की वजह से

- Increased portfolio risk: Higher equity exposure का मतलब है आपका portfolio अब ज्यादा volatile हो गया है

- Tax planning window: March 2026 से पहले tax loss harvesting का last chance

- New FY preparation: 2026-27 के लिए fresh asset allocation strategy set करने का ideal time

JP Morgan की recent report के अनुसार, 2024 में diversified portfolios को strong results मिले हैं mainly क्योंकि public equity के exceptional returns थे। लेकिन अब बहुत से investors को rebalancing trade consider करनी होगी जो equity exposure को reduce करे और दूसरे asset classes को favour करे।

महत्वपूर्ण तथ्य: December में rebalancing करने से आपको तीन महीने का extra time मिलता है अपनी tax planning को finalize करने के लिए, जो March में rush करने की जगह ज्यादा strategic decisions लेने में help करता है।

Step-by-Step Portfolio Rebalancing Process

Portfolio rebalancing एक systematic process है जो disciplined approach की demand करती है। यहां complete step-by-step guide है जो आपको professional तरीके से rebalancing करने में help करेगी:

Step 1: अपने Current Portfolio को Review करें

सबसे पहले अपने portfolio की complete picture देखें:

- Asset allocation check: Calculate करें कि currently आपका कितना percentage equity में है, कितना debt में, और कितना gold या other assets में

- Performance analysis: हर asset class ने इस year कितना return दिया है, ये देखें

- Unrealized gains/losses: कौन से investments profit में हैं और कौन से loss में, ये identify करें

- Holding period check: कौन से investments short-term हैं (12 months से कम) और कौन से long-term (12 months से ज्यादा)

Example: मान लीजिए आपका original plan था 60% equity, 30% debt, 10% gold। लेकिन market growth के बाद अब ये बन गया है 72% equity, 22% debt, 6% gold। ये 12% equity overweight है जो rebalancing की जरूरत indicate करता है।

Step 2: Target Asset Allocation 2026 Define करें

अगले financial year के लिए अपना ideal asset allocation decide करें based on:

- Age और investment horizon: अगर आप 30-40 age group में हैं, तो 70-80% equity reasonable है। 40-50 में 60-70%, और 50+ में 50-60% equity consider करें

- Risk tolerance: Market volatility के साथ आप कितना comfortable हैं

- Financial goals: Retirement, children education, home purchase – आपके goals क्या हैं और कब achieve करने हैं

- Market outlook 2026: Experts suggest करते हैं कि 2026 में large-cap stocks को favour करें, साथ में quality debt instruments add करें

Asset Allocation Guidelines 2026:

Conservative Investors: 50% Large-cap equity, 35% Debt funds/Fixed income, 10% Gold ETF, 5% Liquid funds

Moderate Risk-takers: 65% Equity (40% Large-cap + 20% Mid-cap + 5% Small-cap), 25% Debt, 10% Gold

Aggressive Investors: 80% Equity (35% Large-cap + 30% Mid-cap + 15% Small-cap), 15% Debt, 5% Alternative assets

Step 3: Deviation Calculate करें

अब calculate करें कि actual allocation और target allocation में कितना gap है:

- अगर equity 66% target से 72% actual हो गया है, तो 6% sell करना होगा

- उस 6% को underweight assets में reinvest करें जैसे debt या gold

- Threshold-based approach use करें: जब भी किसी asset class में ±5-10% का deviation हो, rebalance करें

Step 4: Tax-Efficient Rebalancing Strategy Execute करें

Rebalancing करते time tax implications को ध्यान में रखें:

- Long-term holdings prefer करें selling के लिए: LTCG tax 12.5% है (₹1.25 lakh exemption के बाद), जो STCG के 20% से कम है

- Loss-making positions को strategically sell करें: Tax loss harvesting के लिए

- Systematic approach: Ek saath sab kuch sell न करें, phased manner में execute करें

- Transaction costs minimize करें: Unnecessary buying-selling avoid करें

Step 5: New Allocation Implement करें

Rebalancing के बाद:

- Sold amount को target assets में invest करें

- अगर fresh money add कर रहे हैं, तो underweight categories में allocate करें

- SIP/STP routes use करें gradual rebalancing के लिए

Step 6: Documentation और Monitoring

- सभी transactions की proper record रखें tax filing के लिए

- Quarterly monitoring schedule set करें

- Next rebalancing date fix करें (typically 6-12 months)

Tax Loss Harvesting Strategies December 2025

Tax loss harvesting एक powerful strategy है जो आपकी tax liability को significantly reduce कर सकती है। December 2025 में ये especially important है क्योंकि आपके पास March 2026 deadline से पहले proper planning का time है।

Tax Loss Harvesting क्या है

Tax loss harvesting का मतलब है deliberately उन investments को sell करना जो currently loss में चल रहे हैं, ताकि आप उन losses को अपने capital gains के against set-off कर सकें और tax liability reduce कर सकें।

India में Tax Rules FY 2025-26

Short-Term Capital Gains (STCG):

- Equity shares या equity mutual funds जो 12 months या less hold किए गए

- Tax rate: 20%

- STCG losses को STCG gains के against set-off कर सकते हैं

Long-Term Capital Gains (LTCG):

- Assets जो 12 months से ज्यादा hold किए गए

- Tax rate: 12.5% (₹1.25 lakh की exemption के बाद)

- LTCG losses को only LTCG gains के against set-off कर सकते हैं

- Important: July 23, 2024 से पहले sold securities के लिए ₹1 lakh exemption था

Tax Loss Harvesting Strategy Step-by-Step

Step 1: Loss-making investments identify करें

- Apne portfolio में देखें कौन से stocks या mutual funds loss में हैं

- Calculate करें unrealized loss amount

- Short-term और long-term losses को separately classify करें

Step 2: Gains के साथ match करें

- Agar aapne iss year ₹1,00,000 का STCG realize किया hai

- Aur aapke paas ₹40,000 loss mein ek stock hai

- Usko sell karke aap apna taxable STCG reduce kar sakte hain ₹60,000 tak

- Tax saving: ₹40,000 × 20% = ₹8,000

Step 3: Timing optimize करें

- 31 March 2026 से पहले realize करना जरूरी है losses ko

- December-January ideal time hai क्योंकि market usually volatile hota hai year-end pe

- Market dips ko utilize karein loss booking ke liye

Step 4: Wash sale rules ध्यान में रखें

- India में technically wash sale rule नहीं है, लेकिन GAAR (General Anti-Avoidance Rule) apply ho sakta hai

- Same security turant repurchase करने se avoid karein – at least 30-45 days ka gap rakhein

- Similar asset class mein invest kar sakte hain (example: ek IT stock sell karke doosra IT stock buy karna)

Real-Life Example:

Portfolio Status: LTCG from mutual funds: ₹3,00,000 | Unrealized loss in Stock ABC: ₹50,000 (held for 18 months)

Without tax loss harvesting: Tax on ₹3,00,000 – ₹1,25,000 exemption = ₹1,75,000 taxable | Tax = ₹1,75,000 × 12.5% = ₹21,875

With tax loss harvesting: Sell Stock ABC, realize ₹50,000 loss | New taxable LTCG = ₹3,00,000 – ₹50,000 – ₹1,25,000 = ₹1,25,000 | Tax = ₹1,25,000 × 12.5% = ₹15,625 | Tax Saved: ₹6,250

December 2025 Tax Planning Checklist

- Portfolio review karein aur unrealized losses identify karein

- STCL aur LTCL ko classify karein

- Realized capital gains ke saath match karein

- Loss-making assets ko 31 March 2026 se pehle sell karein

- Proper documentation maintain karein

- Reinvestment proper gap ke saath karein GAAR se bachne ke liye

- ITR filing due date se pehle file karein (likely July 31, 2026)

Asset Allocation Guidelines for 2026

2026 ke liye asset allocation strategy banate time current market dynamics aur expected trends ko consider karna critical hai। Indian market outlook 2026 ke liye generally positive hai, lekin smart diversification aur strategic positioning zaroori hai।

Market Outlook 2026: Key Drivers

Positive Factors:

- Infrastructure boom: Government ne ₹100 trillion ka investment plan announce kiya hai infrastructure projects mein across roadways, railways, ports, aur urban development

- Domestic demand strong: Private consumption growth momentum dikha raha hai 2025 ke second half mein

- Manufacturing push: Make in India initiatives se manufacturing sector ko boost mil raha hai

- Digital transformation: IT sector ki demand increasing hai as global businesses digital transformation pe focus kar rahe hain

- Political stability: Stable government policies long-term investments ko support kar rahi hain

Risk Factors:

- Global economic slowdown ki possibility

- High valuations in certain segments (especially small-cap)

- Interest rate uncertainty

- Geopolitical tensions

Sector-Wise Allocation Strategy 2026

Priority Sectors (Higher Allocation):

1. Large-Cap Stocks (35-40% of equity allocation)

- Banking aur financial services – stable balance sheets aur low interest rate environment beneficial hai

- Infrastructure – government spending pickup se direct benefit

- IT services – global digital transformation demand

- Healthcare – long-term structural growth potential (India mein only 1.4 beds per 1,000 people)

2. Quality Debt Instruments (25-35% overall portfolio)

- Government securities aur AAA-rated corporate bonds

- Dynamic bond funds for interest rate management

- Short-duration funds for stability

- Gilt funds for safety-conscious investors

3. Gold/Commodities (5-10%)

- Gold ETFs for inflation hedge

- Sovereign Gold Bonds for better returns than physical gold

- Acts as portfolio diversifier with low correlation to equity

Moderate Allocation:

4. Mid-Cap Stocks (15-20% of equity)

- Select quality mid-caps with strong fundamentals

- Focus on companies benefiting from domestic consumption

- Avoid overvalued segments

5. Real Estate (REITs) (5-10%)

- Premium real estate segment sustained demand dikha raha hai

- Rate cuts se end-buyers ko benefit expected hai

- REITs provide real estate exposure without direct property ownership hassle

Lower Allocation/Selective:

6. Small-Cap Stocks (5-10% of equity)

- High risk-high return segment

- Only for aggressive investors with long time horizon

- Select stocks with proven business models

7. International Diversification (5-10%)

- US index funds for dollar exposure

- Developed markets for stability

- Reduces India-specific risk

Sample Portfolio 2026 (Moderate Risk):

- Large-cap equity funds: 30%

- Mid-cap equity funds: 15%

- Small-cap/Flexi-cap funds: 10%

- Debt funds (corporate + govt): 25%

- Gold ETF/Sovereign Gold Bonds: 10%

- International funds: 5%

- REITs/Alternative assets: 5%

Expected Returns: 12-15% annually | Risk Level: Medium | Suitable for: Investors with 5-7 year horizon

Rebalancing Frequency 2026

- Time-based: Har 6 months mein review (June aur December)

- Threshold-based: Jab bhi kisi asset class mein ±5-8% deviation ho

- Event-based: Major life events (job change, marriage, child birth) ya market corrections pe

Portfolio Rebalancing Mein Common Mistakes

Mistake 1: Rebalancing ko ignore karna

Bahut se investors apne portfolio ko “set and forget” mode mein chod dete hain। Isse portfolio risk increase hota hai aur returns optimize nahi hote।

Mistake 2: Emotions se driven decisions

Market euphoria mein over-allocate karna ya panic mein sab sell kar dena – dono galat hai। Disciplined approach follow karein।

Mistake 3: Tax implications ignore karna

Rebalancing karte time tax impact ko calculate nahi karna costly mistake hai। Har transaction ki tax liability calculate karein।

Mistake 4: Transaction costs ko underestimate karna

Frequent rebalancing se brokerage aur other costs badh sakte hain। Cost-benefit analysis karein।

Mistake 5: Short-term performance pe focus karna

Last quarter ke performance dekh kar pura strategy change mat karein। Long-term view maintain karein।

Actionable Takeaways: Next 30 Days Mein Kya Karein

Week 1 (December 1-7):

- Complete portfolio audit karein – all holdings, current values, unrealized gains/losses

- Original asset allocation plan nikaalein aur current allocation se compare karein

- Tax impact calculator use karke potential tax liability estimate karein

Week 2 (December 8-14):

- Target asset allocation 2026 finalize karein based on risk profile aur goals

- Tax loss harvesting opportunities identify karein

- Transaction plan banayein – kya sell karna hai, kya buy karna hai

Week 3 (December 15-21):

- Phase 1 execution: Tax loss harvesting transactions complete karein

- Loss-making positions ko realize karein strategically

- Documentation start karein tax filing ke liye

Week 4 (December 22-31):

- Phase 2 execution: Asset reallocation complete karein

- Overweight assets sell karein aur underweight assets mein invest karein

- January SIP/STP setup karein gradual rebalancing ke liye

- Next review date calendar mein mark karein (June 2026)

Professional Help Kab Lein:

Agar aapka portfolio size ₹50 lakh se zyada hai, ya aapko tax planning mein confusion hai, toh SEBI-registered investment advisor ya certified financial planner se consult karna advisable hai। Professional guidance se aap costly mistakes avoid kar sakte hain।

Conclusion: Smart Rebalancing Se Wealth Building

Portfolio rebalancing December 2025 mein ek critical activity hai jo aapke investment success ko directly impact karti hai। Systematic rebalancing se aap apne portfolio ki risk ko control karte hain, tax efficiency improve karte hain, aur long-term wealth creation ke liye strong foundation banate hain।

Remember: Market timing se zyada important hai time in market aur disciplined portfolio management। December 2025 aapko ek golden opportunity de raha hai apne portfolio ko optimize karne ka aur 2026 ko financially strong start karne ka।

Abhi action lein: Portfolio review start karein, tax planning karein, aur strategic rebalancing execute karein। Agle 30 days mein liye gaye decisions aapke portfolio performance ko next 1-2 years tak impact karenge।

Market100x ko follow karein aur daily investment insights, portfolio strategies, aur market analysis paayein। Aapki wealth building journey mein hum aapke saath hain!

📱 Instagram: @market100x

🎥 YouTube: Market100x

🌐 Website: market100x.com

Frequently Asked Questions (FAQs)

Q1: Portfolio rebalancing kitni baar karni chahiye?

Answer: Ideally har 6-12 months mein portfolio rebalancing karni chahiye। Time-based approach mein December aur June best months hain। Threshold-based approach mein jab bhi kisi asset class mein 5-10% ka deviation ho, tab rebalance karein। Market volatility zyada ho toh quarterly review bhi consider kar sakte hain।

Q2: Tax loss harvesting se kitna tax save ho sakta hai?

Answer: Tax loss harvesting se aap apni taxable capital gains ko reduce kar sakte hain। STCG pe 20% tax rate se, agar aap ₹1 lakh ka loss realize karte hain, toh ₹20,000 tax save ho sakta hai। LTCG pe 12.5% rate se, same ₹1 lakh loss pe ₹12,500 saving hogi। Actual saving aapke total gains aur loss amount pe depend karti hai।

Q3: December mein portfolio rebalancing karte time sabse important factor kya hai?

Answer: Sabse important factor hai tax efficiency। December year-end hai toh aapke paas March 2026 tak time hai tax planning finalize karne ka। Tax loss harvesting opportunities identify karna, holding period check karna (STCG vs LTCG), aur strategic selling/buying karna critical hai। Saath hi transaction costs aur market timing bhi consider karein।

Q4: Asset allocation 2026 ke liye best strategy kya hai?

Answer: 2026 ke liye large-cap stocks aur quality debt instruments ko priority dein। Suggested allocation: 60-65% equity (mainly large-cap aur select mid-cap), 25-30% debt funds, 10% gold/commodities। Infrastructure, banking, IT, aur healthcare sectors ko favor karein। Small-cap exposure limit karein kyunki valuations high hain। International diversification ke liye 5-10% allocate kar sakte hain।

Q5: Rebalancing ke time kya pehle sell karein ya pehle buy?

Answer: Generally pehle overweight assets sell karein, phir underweight assets mein invest karein। Isse aapko clarity milti hai ki kitna capital available hai reinvestment ke liye। Lekin agar aap fresh money add kar rahe hain, toh directly underweight categories mein invest kar sakte hain bina selling ke। Tax implications aur transaction costs ko bhi consider karein sequence decide karte time।

Q6: Mutual fund portfolio rebalancing alag hai individual stocks se?

Answer: Fundamentally process same hai, lekin mutual funds mein thoda easy hai। Mutual funds already diversified hote hain, toh aapko individual stock selection ki tension nahi hoti। Redemption aur investment bhi simpler hai। Lekin tax treatment same hai – holding period, STCG/LTCG rules same apply hote hain। Mutual funds mein STP (Systematic Transfer Plan) option hota hai jo gradual rebalancing mein help karta hai।